Finest Credit Union in Cheyenne Wyoming: Tailored Banking Services for You

Finest Credit Union in Cheyenne Wyoming: Tailored Banking Services for You

Blog Article

Discover the Benefits of Credit Report Unions Today

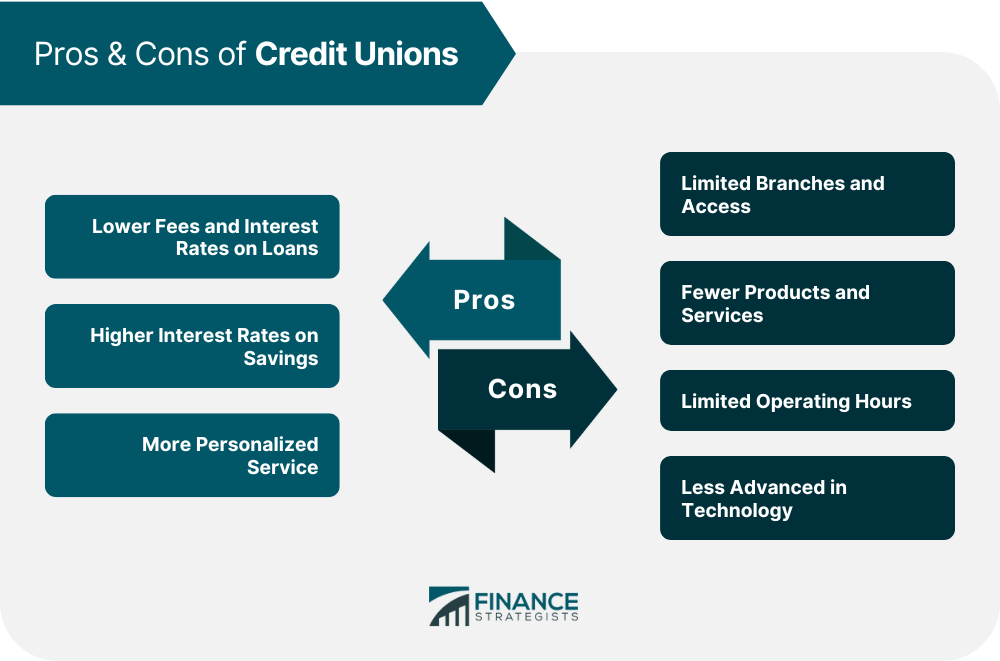

Cooperative credit union stick out for their distinct method to monetary solutions, offering a distinct set of advantages that accommodate their members' requirements in such a way that standard banks often struggle to match. From personalized customer care to competitive rates of interest and a community-focused approach, lending institution offer a compelling choice for individuals seeking greater than just the common financial experience. By checking out the advantages of lending institution better, one can discover a banks that prioritizes its members' economic health and intends to construct long-term partnerships based upon count on and support.

Membership Advantages

Membership advantages at credit report unions include a spectrum of monetary rewards and solutions customized to promote member success and well-being. One significant advantage of lending institution membership is the individualized customer care that members receive. Unlike typical financial institutions, cooperative credit union typically focus on building solid connections with their participants, using a much more tailored experience. This can include monetary counseling, aid with lending applications, and tailored referrals to assist participants achieve their economic objectives.

Additionally, cooperative credit union frequently offer access to lower rate of interest on lendings, greater rate of interest on interest-bearing accounts, and decreased charges compared to bigger financial establishments. Participants can benefit from these favorable rates to save cash on finances or expand their savings much more effectively. Furthermore, cooperative credit union commonly supply a variety of economic services and products, such as charge card, home loans, and retired life accounts, all developed to satisfy the varied needs of their participants.

Reduced Costs and Better Rates

Credit history unions stick out for their commitment to providing lower costs and far better rates, lining up with their mission to supply members economic benefits that traditional banks might not prioritize. Unlike banks that aim to make best use of revenues for investors, lending institution are not-for-profit organizations owned by their participants. This structure permits lending institution to concentrate on serving their participants' benefits, causing lower costs for services such as checking accounts, car loans, and debt cards. Furthermore, credit history unions frequently supply much more competitive rates of interest on savings accounts and fundings contrasted to standard financial institutions. By keeping fees low and prices affordable, credit report unions aid participants save cash and achieve their economic goals a lot more successfully. Members can take advantage of reduced prices on necessary financial services while earning higher returns on their deposits, making lending institution a preferred option for those seeking useful and cost-effective financial services.

Area Involvement and Assistance

Energetic neighborhood involvement and assistance are essential aspects of lending institution' operations, showcasing their devotion to fostering local links and making a favorable impact beyond monetary solutions. Unlike typical banks, cooperative credit union prioritize community engagement by proactively getting involved in neighborhood occasions, supporting philanthropic causes, and using financial education programs. By being deeply ingrained in the neighborhoods they offer, credit report unions demonstrate a real dedication to improving the well-being of their members and the neighborhoods in which they run.

With campaigns such as volunteering, funding community occasions, and providing scholarships, credit scores unions develop themselves as columns of support for neighborhood residents. This active involvement exceeds simply supplying economic services; it produces a feeling of belonging and solidarity among participants. Furthermore, cooperative credit union commonly team up with other regional organizations and companies to resolve neighborhood requirements effectively. By cultivating these solid community connections, lending institution not just boost their credibility however likewise contribute to the overall growth and success of the areas they serve.

Personalized Financial Providers

With a Discover More Here concentrate on satisfying the one-of-a-kind financial requirements of their participants, cooperative credit union use individualized economic services tailored to private situations and goals. Unlike typical banks, lending institution prioritize developing partnerships with their members to understand their certain monetary situations. This individualized technique allows debt unions to offer personalized remedies that straighten with participants' lasting objectives.

Credit score unions give a variety of customized monetary services, consisting of tailored financial assessments, customized funding items, and personalized financial investment advice. By making the effort to understand each participant's financial objectives, lending institution can use pertinent and targeted support to aid them achieve monetary success.

Furthermore, lending institution usually supply tailored budgeting aid and financial preparation devices to assist members manage their money successfully. These resources equip members to make informed economic choices and work towards their wanted economic results.

Improved Customer Care

In the world of monetary establishments, the arrangement of phenomenal customer care collections cooperative credit union in addition to other entities in the sector. Lending institution are known for their dedication to putting members first, providing a more tailored technique to client service compared to standard financial institutions. One of the crucial advantages of credit unions is the improved degree of consumer solution they supply. Members commonly have direct accessibility to decision-makers, permitting quicker reactions to questions and a much more customized experience.

In addition, cooperative credit union generally have a strong concentrate on structure partnerships with their participants, aiming to understand their unique monetary needs and goals. This individualized attention can result visit our website in better monetary advice and better item suggestions. Furthermore, cooperative credit union staff are frequently applauded for their friendliness, desire to aid, and total dedication to participant satisfaction.

Conclusion

To conclude, cooperative credit union use a range of advantages consisting of personalized customer care, lower charges, far better prices, and area involvement. By prioritizing participant complete satisfaction and monetary health, credit scores unions concentrate on offering their members' benefits and assisting them accomplish their economic objectives efficiently. With a commitment to offering competitive prices and individualized financial solutions, cooperative credit union continue to be a reputable and customer-focused option for people seeking economic help.

By checking out the benefits of debt unions further, one can uncover an economic institution that prioritizes its participants' monetary health and intends to develop long-term partnerships based on trust fund and assistance.

Credit rating unions commonly use a variety of economic items and solutions, such as credit score cards, home loans, and retired life accounts, all designed to Website satisfy the varied needs of their participants. - Wyoming Credit Unions

With a focus on meeting the unique monetary demands of their members, credit report unions supply customized financial solutions tailored to specific scenarios and objectives. By prioritizing participant satisfaction and monetary well-being, credit score unions focus on serving their participants' finest passions and assisting them accomplish their economic objectives successfully.

Report this page